The COVID-19 pandemic fundamentally changed how we approach our daily lives, and years later in 2025, its impact continues to shape our routines, especially how we shop for groceries. What began as a crisis driven shift toward buying locally and focusing on necessities has now solidified into a long-term consumer mindset, primarily due to persistent economic uncertainty, global trade concerns, and a sustained desire for product transparency.

Grocery shopping, once a routine errand, remains a carefully considered, strategic decision. While Canadians are still engaging in more online ordering and seeking convenience, the shift towards prioritizing locally sourced products has endured and is now driven by three evolved, powerful reasons:

1. Affordability and Economic Resilience (Evolved from “Supporting Canadian Companies”)

While the initial motivation was a patriotic desire to support Canadian businesses during the pandemic’s economic shock, this has evolved into a necessity. In 2025, high inflation and the rising cost of living have become the primary drivers of consumer choice.

-

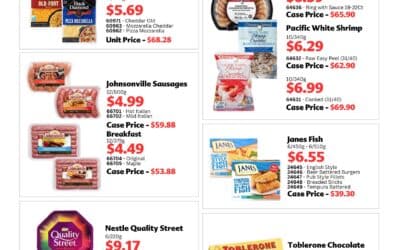

Financial Precarity: Grocery price increases have outpaced general inflation for years. Canadians are strategically seeking value, often “trading down” to private label or discount brands.

-

A New Patriotism (Trade Driven): Recent geopolitical and trade tensions, particularly with the U.S., have added a new layer of incentive. A significant percentage of consumers actively look to ‘Buy Canadian’ to reduce reliance on foreign supply chains and avoid potential tariff driven price hikes, even if the domestic option costs slightly more.

-

The Stickiness of Local: The support for Canadian companies remains strong, but the rationale has broadened from an emotional plea to a calculated strategy to support a more resilient domestic economy that is less vulnerable to global shocks. CJR’s continued commitment to Canadian owned operations and carrying brands like Maple Leaf Foods and Canada Bread aligns directly with this desire for stability.

2. Supply Chain Transparency and Trust (Evolved from “Food Safety”)

The pandemic exposed the fragility of global supply chains, elevating a concern for food safety to a deeper demand for supply chain transparency and trust. In 2025, health concerns related to viral transmission have largely faded, but the need for information about a product’s journey has not.

-

Beyond the Virus: Concerns have shifted from fear of COVID 19 on packaging to anxiety about ingredient integrity, ethical sourcing, and overall food quality. Consumers want proof, not just assurances.

-

Traceability is Key: A shorter supply chain is still perceived as a safer, more transparent one. Consumers increasingly demand to know the provenance of their food where it was grown, how it was processed, and how long the journey took. Technologies like QR codes and advanced labelling are being used to provide this “farm to table” visibility.

3. The Enduring Value of Convenience and Locality (Evolved from “Geography”)

The pandemic era habit of staying in one’s immediate neighbourhood has persisted, transforming into a fundamental appreciation for extreme convenience and the local ecosystem.

-

The Hybrid Lifestyle: With many Canadians maintaining hybrid work models in 2025, the convenience of local shopping remains highly relevant. Quick, efficient local runs replace less frequent, longer trips.

-

Local Infrastructure: Companies like Rabba Fine Foods, with their numerous 24/7 GTA locations, have cemented their role as trusted neighbourhood anchors. The public perception of a store’s high standards for cleanliness and reliable stock, established during the peak of the pandemic, continues to build loyalty in a time where product availability is still a key shopper frustration.

The impact of the COVID 19 pandemic and the subsequent era of high inflation have not just changed consumer habits; they have instilled a precarity mindset. This means Canadians are more cautious, strategic, and disciplined in their spending, ensuring the enduring relevance of supporting a transparent, local, and resilient food system in 2025 and beyond.