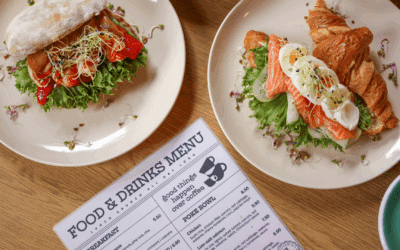

Meal kits surged in popularity during the early days of the pandemic as lockdowns kept people at home and searching for new meal ideas. These kits offered a convenient solution for those wanting to try new recipes or learn how to cook. However, as consumer habits evolve and inflation rises, the demand for meal kits is shifting.

From Necessity to Luxury

Initially viewed as a convenient necessity, meal kits are now often considered a luxury or occasional treat. According to marketing expert Mo Dezyanian, “As the pandemic has gone on, the product of meal kits has gone from a necessity and a convenience item to a luxury, to a treat.”

The Cost Factor

Rising food costs are encouraging consumers to look for more budget-friendly solutions. Sylvain Charlebois, lead author of Canada’s Food Price Report, predicts that many households will trade the convenience of meal kits and grocery delivery for more cost-effective options.

“With food prices expected to rise between 5% and 7% this year, and meal kits forecasted to increase even more—up to 8% beyond inflation—many are reconsidering their spending habits,” Charlebois notes.

Meal kits, while offering convenience and inspiration, come at a premium. As Janet Music, a research associate at the Agri-Food Analytics Lab, explains, “People are looking to cut down on their grocery bills, so they’re going to do [meal prep] themselves.”

Adapting to a Competitive Landscape

Meal kit companies face significant challenges, from rising inflation and geopolitical issues to the reopening of restaurants and easing of lockdowns. In response, some companies are pivoting to online marketplaces, offering additional grocery items and customizable options beyond meal subscriptions.

Brands like Imperfect Foods and HelloFresh have embraced this shift, expanding their product lines to cater to changing consumer preferences.

Opportunities for Grocery Retailers

Grocery stores are also stepping into the meal kit space, recognizing the potential to offer convenience at a lower price point. A survey by the Agri-Food Analytics Lab and Caddle found that grocers are improving their delivery services, with some now offering their own meal kits.

The convenience factor keeps customers coming back. According to NielsenIQ, over 80% of online grocery shoppers return to buy more food online. Music highlights the advantage grocery stores have: “If grocery stores are selling convenience and meal kits are also selling convenience, people are probably going to default to retailers because it’s much cheaper.”

At CJR Wholesale, we help retailers stay ahead of the curve by offering the products and insights needed to meet evolving consumer demands. Whether it’s meal kits or the latest grocery trends, we’re here to support your business every step of the way.