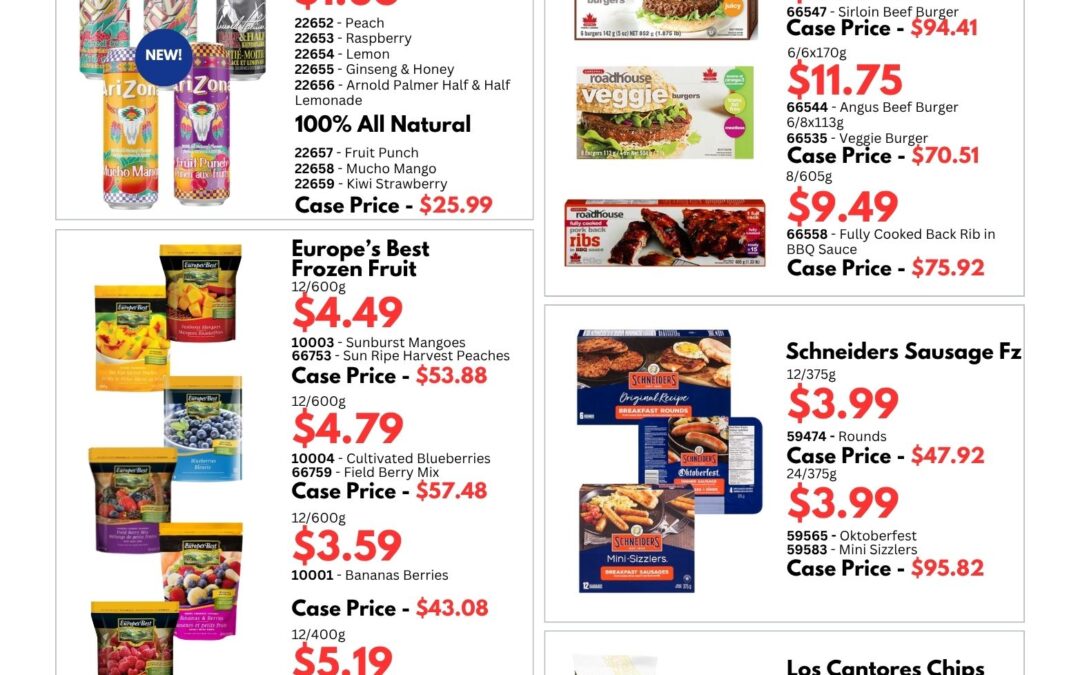

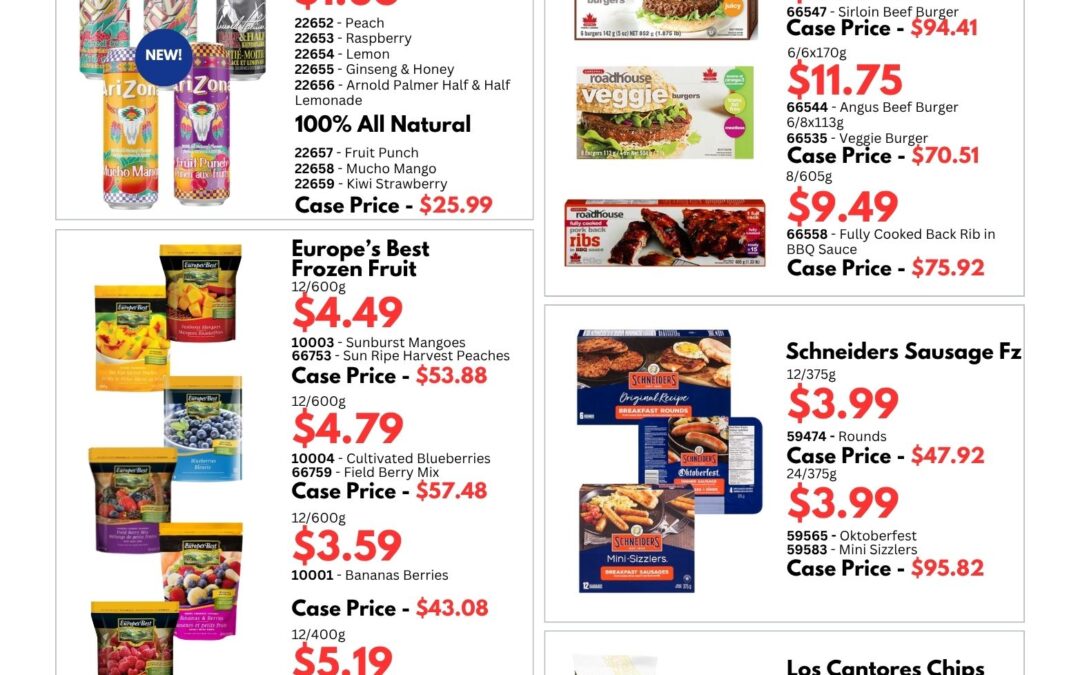

by CJR Wholesale | Jun 24, 2025 | Catalogue

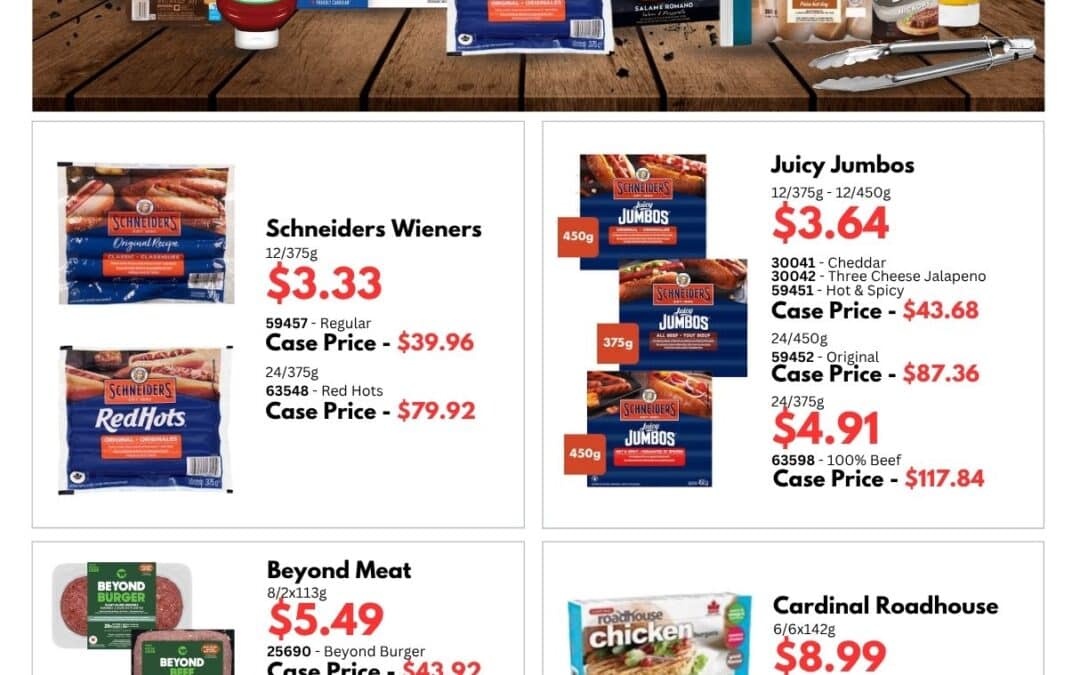

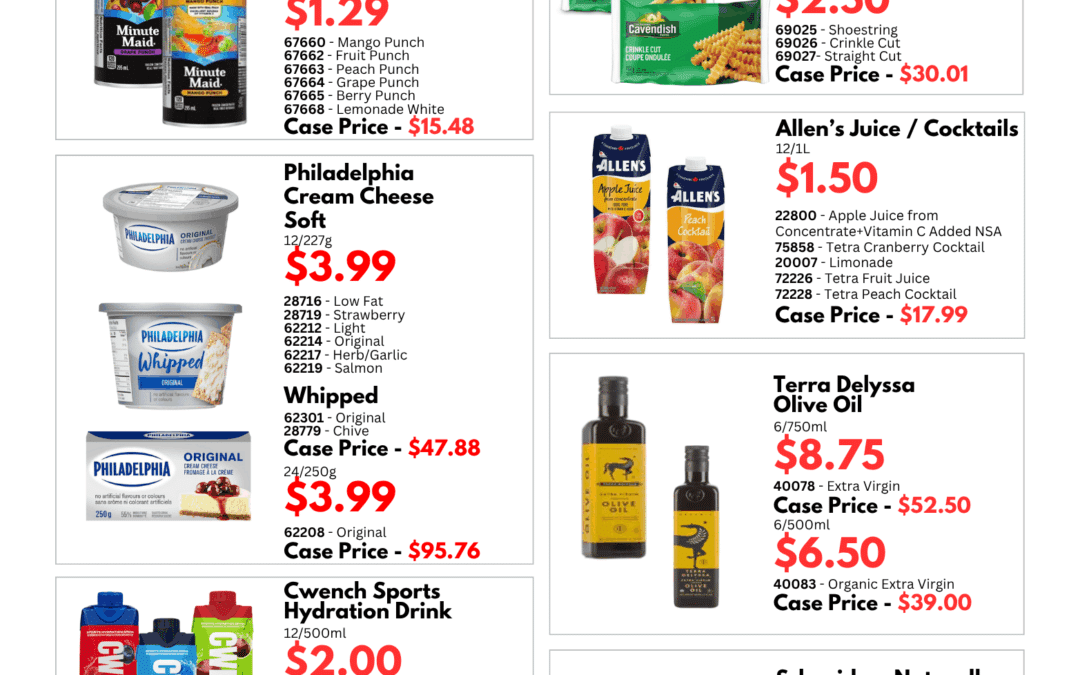

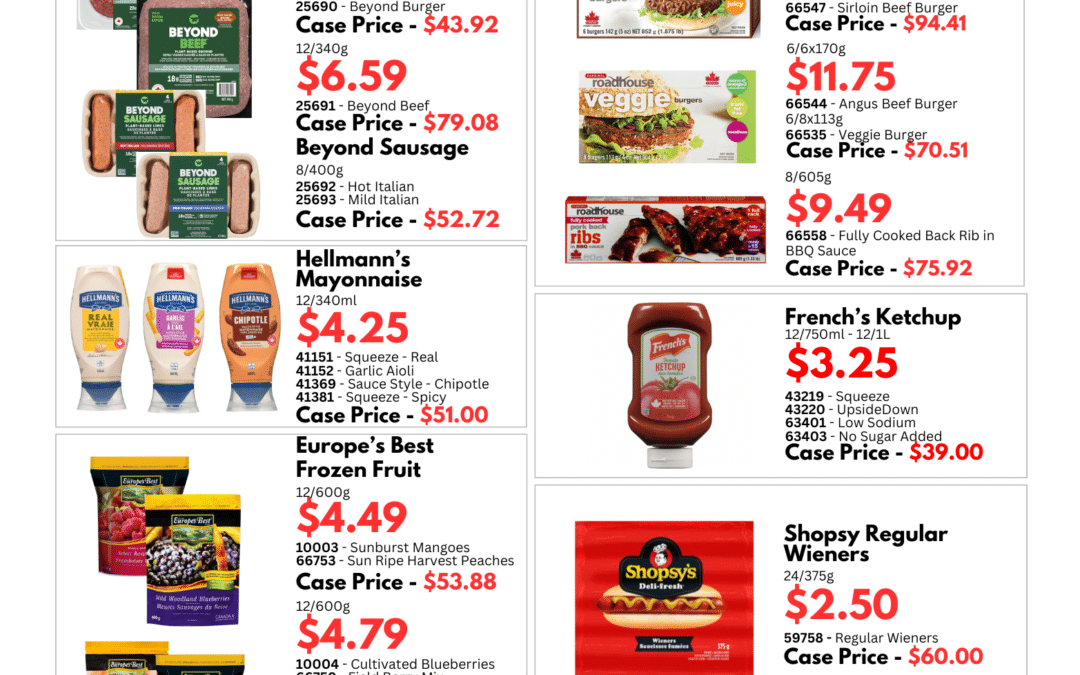

by CJR Wholesale | Jun 24, 2025 | Catalogue

by CJR Wholesale | Jun 23, 2025 | Catalogue

by CJR Wholesale | Jun 18, 2025 | Insert

by CJR Wholesale | Jun 16, 2025 | Flyer

by CJR Wholesale | Jun 10, 2025 | Newsroom

Toronto, ON – June 2025 – For the third time, CJR Wholesale Grocers has been honoured with the Partner of the Year award at the 2025 Distribution Canada Inc. (DCI) / Canadian Independent Grocery Buyers Alliance (CIGBA) Star Awards, held June 3 in Brampton, Ontario....

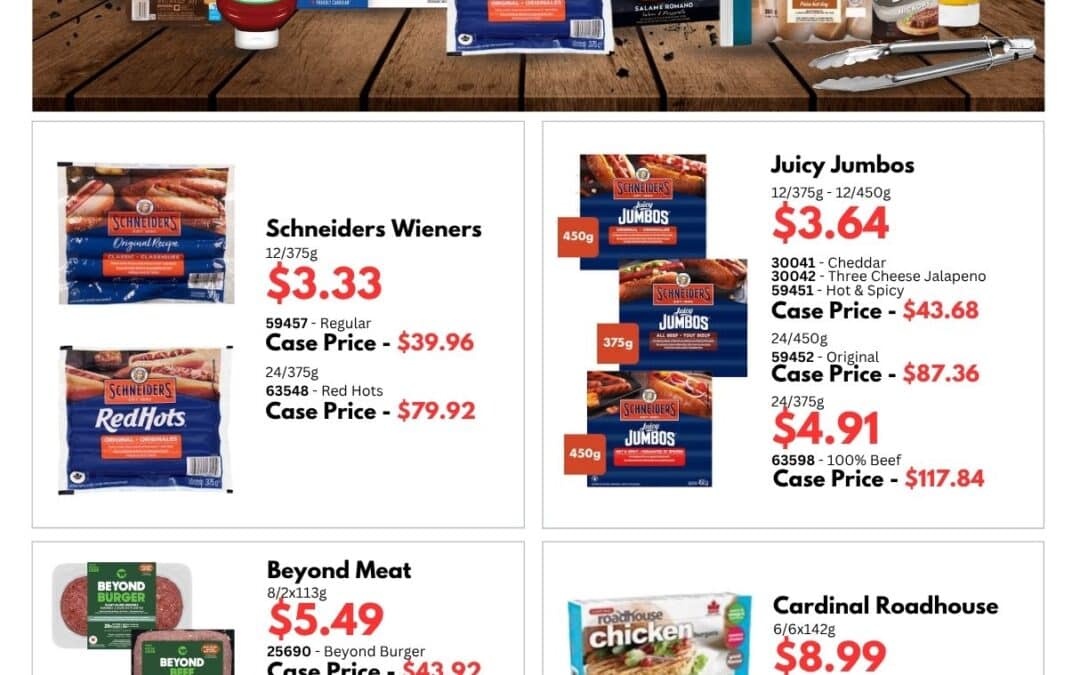

by CJR Wholesale | May 31, 2025 | Flyer

by CJR Wholesale | May 17, 2025 | Flyer

Flyer #11 – May 19 – 30Download

by CJR Wholesale | May 5, 2025 | Insert

Recent Comments